SOUTHAMPTON: Ready to Pass Erosion Tax Law-Town board has ended public hearings on a still-controversial proposal

Although residents of proposed coastal erosion tax districts continue to air their concerns, the Southampton Town Board plans to vote for adoption at its Oct. 25 meeting. The board ended public hearings on the matter on Tuesday.

Supervisor Patrick A. Heaney devised three tax districts to address erosion emergencies and provide funds to plan larger scale beach rebuilding efforts at the residents' discretion. He said state law restricts the town from improving private property on its own.

The beachfront is private property that, because of a town trustee easement that dates to Colonial times, the public can use, Mr. Heaney said. Creating a tax district is the only way that the town can provide a public fund for improvements on property it does not own.

The proposed Southampton East district encompasses the coastal properties of the recently incorporated village of Sagaponack. Southampton West includes the coastal properties of Bridgehampton and Water Mill, along with some bayfront properties that could also be harmed by an oceanfront breach. The Tiana district begins west of the Shinnecock Canal.

Each of the two districts east of the canal would be initially levied $250,000, to establish a reserve fund. The money assessed in subsequent years would depend on how much was spent in the prior year. If no money was spent, no assessment would be necessary. If more was spent, an additional assessment would be needed.

The assessment would be deductible from income taxes. Districts would also be allowed to issue bonds for large replenishment projects that could be paid out over several years instead of one lump sum.

The Towns of Brookhaven and Islip have 11 such districts combined on Fire Island. The town board has been advised by both Senator Hillary Rodham Clinton and Senator Charles Schumer that the formation of these districts will help the town get state and federal grants and resources for its beaches and should also expedite the permitting process. A representative from Mr. Schumer's office sat in on the public hearing on Tuesday.

Sally Breen, a part-time resident of Water Mill who was one of the proponents of the incorporation of a coastal village originally called Dunehampton, presented a letter from her husband, Daniel Breen, along with the results of a survey of coastal property owners and a new version of the law that they would support.

The Breens sent out a survey card on Oct. 3 to 317 households and had received 73 responses as of Tuesday. The results so far indicate that these property owners would support the creation of a coastal tax district but not the one described by the town.

Chief among their concerns were the right to rebuild and ensuring that the money collected would not go to town-owned beaches. The ability to appoint their own "commissioner" of the district was also a popular concern.

The town board maintained that due to some misconceptions the law was actually closer to what property owners were describing than they realized. The town cannot use the dedicated funds raised for the district for their own beach properties. They also pledged to maintain the town-owned beaches up to a safe standard with the town's general funds, which is allowed.

This would include repairs at Flying Point Beach where a resident described a six-to-eight-foot-high cut near the bathhouse that could potentially flood the whole area. Councilwoman Linda Kabot said she would look into it.

The town also adopted the suggestion floated in an informational public hearing in August that a citizens advisory committee be set up for each of the districts to make suggestions for projects and take a role in determining what is to be done in an emergency.

Councilman Steven Kenny, who was the sponsor of the 2003 coastal erosion hazard law, also announced his intention to clarify that law's language to make it clear that homeowners can rebuild their houses after a storm destroys them.

Mr. Kenny said as long as the required amount of beach remains, he always intended that homeowners have the right to rebuild. Lawyers, however, found the language of the town's law ambiguous. He said changing some "mays" to "shalls" in the law should be enough to clarify these rights. The homeowners in attendance were pleased to hear his plan.

Many of those affected had already met with town officials for an informational session with representatives from the Fire Island districts present. Although some still thought the beach was a public benefit and were resistant to the idea of a special assessment, others were happy to have the opportunity to do something to protect their houses.

People who live in Water Mill on the Mecox Bay who were included in the Southampton West District have no interest in being a part of it, according to Mr. Breen and others who spoke at the meeting.

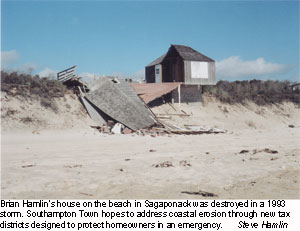

Gary Ireland, a lawyer whose family owns a house in Sagaponack, proposed that the tax be renamed the "Levy Beach Tax" after County Executive Steve Levy, whom he is suing to cut back the groins at Georgica Beach and to replenish sand to the beaches west of them. Mr. Ireland's mother, Cynthia Hamlin Ireland, has had to move her house back two times to save it from the water. He brought the lawsuit, which the town joined last year, under his mother's name.

In 1993, a beach house owned by Mr. Ireland's uncle, Brian Hamlin, was washed out in Sagaponack. Mr. Ireland shared pictures of the ruined building with the town board to underscore what can happen when erosion is not addressed.

Councilman Dennis Suskind told the Bridgehampton Citizens Advisory Committee on Tuesday that the town board would not shove the legislation down anyone's throat. If there is enough resistance in a given district, he thought the town board would vote to withdraw the legislation for that district.

Mr. Breen addressed that possibility in his letter. "While you have indicated a predisposition to simply withdraw your proposal if we complicate it too much . . . the polls indicate that the community is willing to suffer a disproportionate tax burden to improve the public's beaches if the town is willing to work with the community. The property owners appreciate your efforts to provide a fund to protect their homes in the case of an emergency."