At the start of the current academic year, the Amagansett School learned that the federal Department of Education had named it a Blue Ribbon school, one of only three elementary schools on Long Island and one of 353 schools nationally to earn that annual distinction. The award is based largely on students’ academic performance, a metric that few people would label subpar in Amagansett, which educates prekindergarten through sixth grade in-house and sends older children on to East Hampton schools.

How much money does it take to run a Blue Ribbon school?

At the Amagansett School, for next year, the answer is $13.44 million, according to administrators. It’s $273,746 more than the current budget, or about 2 percent more year-over-year.

That is the spending plan that will appear on Tuesday’s school budget ballot. Along with it comes a whopping 7.77-percent proposed increase to the tax levy, which is the total amount the district is authorized to collect from its taxpayers — about 4 percentage points higher than what New York State would have allowed.

This means the district will need at least 60 percent of voters to approve the budget. A failed budget means a re-vote in June; a second failure would mean at least $856,280 in cuts to achieve a contingency budget, which would almost certainly eliminate field trips, extracurricular activities, and prekindergarten for 3-year-olds, school officials said at a budget hearing on Tuesday.

“This is not the district doing a scare tactic. It is what is required by law,” Richard Loeschner, the interim superintendent, explained.

Even with a 7.77-percent tax-levy increase, school officials said they are holding the line — and for the special education program, it means layoffs of four fully certified teachers. Administrators have said the school is currently overstaffed in that area, and that even with four fewer teachers, there will still be five in the special-education program. It will require scheduling changes, they acknowledged, but said they were confident that the students’ needs will still be met.

As of this week, Amagansett enrolls a total of 123 children in-house, 17 of whom are special-ed students. The district employs 35 teachers, inclusive of teaching assistants, for an overall student-teacher ratio of about four to one.

“We are trying to tighten up the budget to reflect what our true needs are. If we kept those four positions in there, piercing the tax cap would have been higher, into the double digits,” Tom Mager, the district treasurer, said in an interview last week. “If we could reduce while still maintaining programs, it wasn’t fair to the taxpayers to go to double digits, and that’s where we arrived at the 7.77-percent tax-levy increase.”

The proposed budget also corrects an oversight that should have been fixed previously, Mr. Mager said: the addition of new programs that were paid for out of the school’s “unassigned, unappropriated fund balance” — meaning surplus money left over from the prior school year.

“We’ve added things to the budget over the years and not actually funded it with taxes,” he said, citing a self-contained special education classroom for kindergarten to third grade. “That was a brand-new classroom — with a teacher as well as two aides, expenditures for sensory items and furniture and desks — that was never funded through taxpayer dollars. That was funded by savings. Our savings run out if we never replenish.”

Another longstanding trend related to savings, or the so-called fund balance, is that Amagansett has been applying huge chunks of it each year to offset taxes for the following year. In recent years the district has applied between $1 million and $1.9 million in this manner. Next year, it will be about $925,000, which is a reduction of over $539,000 in the reliance on fund balance.

“We should be appropriating probably about $500,000 to $600,000. That’s a comfortable number,” Mr. Loeschner said Tuesday, “and you can confidently roll that over into the following budget. But approaching $2 million, that’s why we did have to make some uncomfortable decisions. . . . In a $13 million budget, that’s really not sustainable.”

Many Rising Costs

“Major increases are due primarily to salary contractual obligations, tuition for middle and high school students, and health insurance premiums,” Mr. Loeschner wrote in the school’s budget newsletter earlier this month.

Some examples: Employee benefits are rising by more than $61,000, up to $2.39 million. Special-education expenses, despite the reduction in teaching staff, are still slated to rise by $339,305, up to $2.06 million. The cost of busing children is expected to increase by $99,519, up to $365,044. Maintenance will cost $26,572 more, up to $920,581.

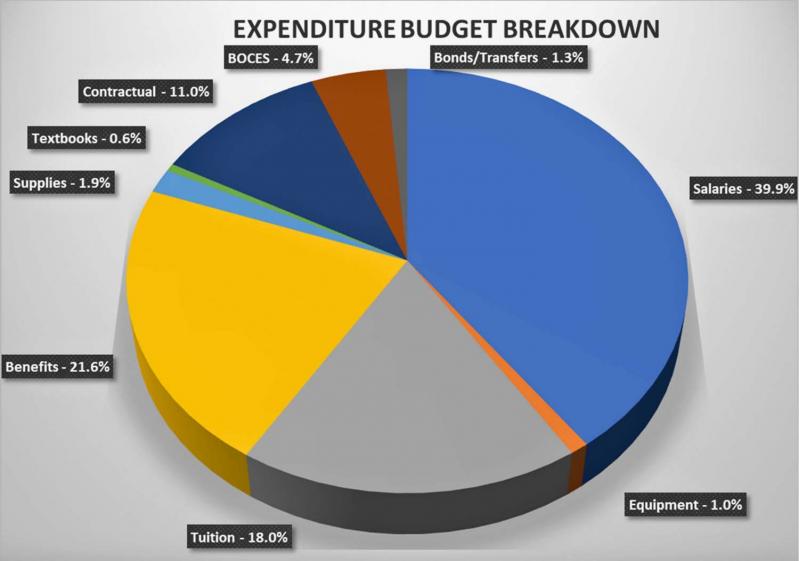

New York State requires every school district to break down its budget into three parts: capital (the cost of operating, including utilities and maintenance); program (including teacher salaries, classroom supplies, textbooks and the like), and administrative (salaries for the superintendent and principal, clerical staff, BOCES costs, and benefits). In Amagansett, program expenses are the biggest area, making up 79 percent — which is on par with surrounding school districts — while capital expenses make up 9 percent and administration costs total 12 percent.

What Folks Are Saying

The Amagansett School PTA “is in full support of the district and the budget,” said Julie Gauger, its president, on Tuesday after the board’s lively budget hearing.

Dan Mongan, a trustee of the Amagansett Library and a parent of two children who attended the school, is planning to vote yes.

“My own take on it is that costs increase,” he said this week, “but the value of what that school does — not just for the students and not just for the families, but for the community and making Amagansett a place, instead of just a postal code — I think it can’t really be measured in money, other than to say if it were twice as expensive, it would still be a bargain.”

Joe Karpinski, a parent of a child in the special-ed program, is planning to vote no, on principle, he said. “The reason is my belief that education comes first. That we should have teachers over luxuries,” by which, he said, he meant programs like after-school clubs and summer enrichment. “Those are things that any other school would have looked at first.”

Inflation, Mr. Karpinski suggested, is always the excuse. “But when inflation was much higher we were still spending and spending,” he said.

At Tuesday’s budget hearing, one longtime resident, Irene Silverman, brought up a polarizing issue. The school principal, Maria Dorr, who has been on administrative leave since December, is still receiving her full salary, which in the 2022-23 school year was $207,467, according to the SeeThroughNY database. Three senior faculty members are splitting many of her duties in her absence.

Concerning Ms. Dorr, Mr. Loeschner replied that “There will be some decisions made over the summertime. We can’t say too much, but yes, the district is obligated to pay [her].”

The Tax Impact

All told, for a house with a market value between $1.5 million and $2.5 million (with a town-assessed value of $6,000), the district estimates the total tax increase for the year would be around $155. That breaks down to about $13 more in taxes per month for such houses.

“Over all, the taxes are very low in Amagansett. When you’re breaking down year-to-year changes, what I ask people is, to look at it holistically,” Mr. Mager said. “Yes, that number might look high, but when you look at the tax rate, $155 on a $6,000 assessed value is very reasonable. When you look at UpIsland properties, for what you get out here it’s a great deal.”

Three ballot propositions, which officials said do not impact taxes, will be on the ballot as well. One is to spend up to $205,000 on repairs to the cupola atop the school building; the money would come from a facilities capital reserve account. Another would allow the district to spend $95,538 on a new school bus, also from the reserve account. The third is to extend busing to students who live within a half-mile of the district; right now a student must live a mile or more away to receive transportation. This proposition would use an existing bus and bus driver.

Dawn Rana Brophy and Robin Jahoda are the two candidates for two seats on the school board. The highest vote-getter will serve a three-year term beginning July 1; the second highest will serve a partial term beginning on Tuesday, as the successor to Kevin Warren, who recently resigned with about two years left on his term.

The school gym will be open for voting on Tuesday, from 2 to 8 p.m.