The national trend of shell companies owning real estate is not a new phenomenon, but it's one that is solidly in play here on the South Fork — presenting benefits for the actual owners and problems of perception in some communities.

A closer look at real estate transfers from Montauk to Southampton Village in the 52-week period leading up to Aug. 17, as published weekly in The Star, reveals that just over 51 percent involved at least one limited liability company.

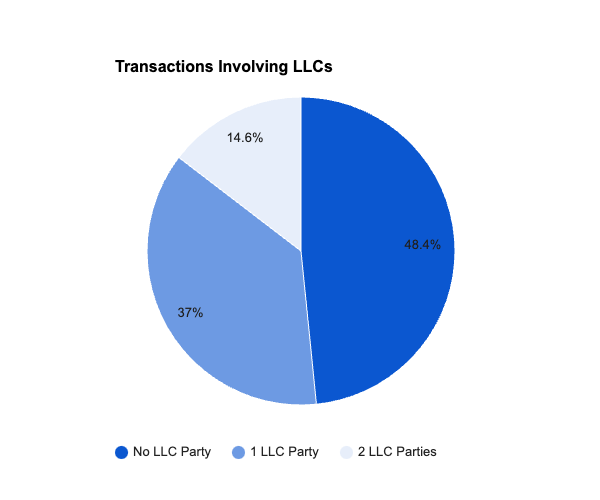

In total, out of approximately 1,257 purchases completed in that time, mostly consisting of residential properties but also including some commercial and vacant parcels, 37 percent involved one L.L.C. and another 15 percent involved two L.L.C.s. About 44.8 percent of the total involved the sale of a property from an individual, estate, or trust to an L.L.C. The data excludes 15 properties for which recorded deeds excluded a specific street number.

According to Investopedia, an online industry publication, an L.L.C. is a type of business that "protects the assets of its owners from lawsuits and creditors concerned with the company's business debts." The Internal Revenue Service says on its website that "individuals, corporations, other L.L.C.s, and foreign entities" are all allowed to be controlling members of this type of business. And functionally, because of the way L.L.C.s are structured, those members are largely permitted to remain anonymous; by contrast, people's names are public when it comes to properties they own outright.

Big Money in Play

The 1,257 transactions examined by The Star represented about $3.07 billion in total sales.

Among them were some attention-grabbing numbers, like the $22 million sale of 1 Main Street in East Hampton Village to an L.L.C. that according to multiple news reports is controlled by Bernard Arnault, whose $211 billion net worth earned him Forbes Magazine's "richest man in the world" title in August 2023. Ownership of 121 Further Lane in East Hampton shifted from 121 Further Lane L.L.C. to 121 Lasata L.L.C. for $52 million, and the Marcia Hirschfeld Trust sold 700 Meadow Lane in Southampton Village to Meerkat L.L.C. for $112.5 million.

In 2022, the website Reinvent Albany reported that 7 percent of properties statewide were owned by L.L.C.s.; in Suffolk, it was about 5 percent. In New York City, it was 37 percent. By comparison, among the 2023 East Hampton Town tax rolls, the most recent assessment available by press time, at least 13.9 percent of the 24,697 parcels in town listed an L.L.C. as an owner. (Those parcels also include preserved lands, commercial and municipal properties, and vacant lots in addition to residentially zoned parcels.)

"On a very surface level, I do hear from people that there is a suspicion when people see so many L.L.C.s. It's also such a different trend than it was 10 years ago. It wasn't a thing," said Jaine Mehring of Amagansett, who closely watches real estate and development trends across East Hampton Town.

In February 2022, on her website, buildinkind.com, Ms. Mehring — who has since been appointed to the East Hampton Town Zoning Board of Appeals, but spoke to The Star independently of that role — wrote about a trend she noticed. "Many real estate transactions and much of the development activity take place outside of the public line of sight," she wrote. "Currently, half of all recorded deed transfers reported out here hide the actual identity of one or both counterparties behind anonymous L.L.C.s. Looking back at The Star's archives, just a decade ago, that 'mystery' portion accounted for only 15 to 20 percent of deed transfers."

While there may be a perception that widespread L.L.C. ownership threatens a community in some way, at least one town official described it as "just a different form of ownership."

"It's not problematic for the town," said Jeanne Nielsen, East Hampton's chair of assessors, "but it is becoming more and more common."

A Level of Anonymity

In New York State, it has grown so common that the government stepped in to chip away at the anonymity afforded to L.L.C.s. In June 2023, State Senator Brad Hoylman-Sigal and Assemblywoman Emily Gallagher — who represent areas of New York City widely impacted by questionable shell companies with substantial real estate holdings — ushered in the L.L.C. Transparency Act, which created a "public database of true owners" with protections for "significant privacy interests." Gov. Kathy Hochul signed it into law in December.

"L.L.C.s are past due for reform," Mr. Hoylman-Sigal said in a September 2023 blog post on his official Senate website. "It's a farce that New York requires more information to get a library card than to set up a limited liability company. The anonymity and lax regulations around L.L.C.s have allowed them to be exploited by international tax cheats, slumlords, and shady employers to evade the law and rip off the general public."

According to Adam Miller, who in 2007 launched a Bridgehampton law practice that handles many real estate and land-use cases, L.L.C.s make the most sense when a person wants privacy. "When you get above a certain threshold of price, many of the people who can afford those homes would prefer the anonymity," he said. "Why let the public know where you live when for a couple of thousand bucks you can protect that?"

The South Fork's assemblyman, Fred W. Thiele Jr., was a co-sponsor of the L.L.C. bill, which he supported under the belief that "with rare exceptions, that information should be public," he said in an email last week. "Also, I was supportive of the bill because of the impact on the community preservation fund. When tax dollars are used to buy land for conservation, the towns and the public should know who the sellers are to avoid any possibility of a conflict of interest or other possible violation of the public trust."

He acknowledged, however, that "the impact of the law is rather limited. Absent the consent of the L.L.C. owners, a court order, or a government agency performing its official duties, the public will not have access to this information."

It was "a step in the right direction," Mr. Thiele said, "but I think the burden for exemption based on privacy should be on the L.L.C., rather than a blanket exemption from public disclosure."

Behind the Hedgerows

In both East Hampton and Southampton Towns, there are streets with entire rows of tony houses owned by L.L.C.s — Further Lane in East Hampton and Hedges Lane in Sagaponack, for instance. L.L.C. ownership is also prevalent on blocks that have been in the news lately, like Handy Lane in Amagansett and Marsden Street in Sag Harbor.

Denise Schoen, an attorney at the Adam Miller Group and a former Sag Harbor Village attorney, said there are three main reasons why L.L.C.s are used in real estate transactions. The first is privacy, although Ms. Schoen said that with the L.L.C. Transparency Act, they "can't promise anonymity anymore."

The second reason is potentially better liability protections, as L.L.C.s should be run as businesses. The third has to do with the concept of single and separate ownership. As Ms. Schoen explained, "Sometimes we have people who buy properties next door to each other and they want the properties to stay in single ownership so they don't merge." She laid out a hypothetical situation where a person may buy two adjacent lots. "They will go to the building department and find out they can [only] have one house," she said. By owning adjacent lots through separate L.L.C.s, one person or entity can build separate houses on them.

Four vacant lots on Marsden Street in Sag Harbor encompass a real-life example of this. Last year, the Sag Harbor School District attempted to buy them for athletic fields, but a ballot referendum failed to gain enough support. The L.L.C. that owned the four vacant lots in question, 7, 9, 11, and 15 Marsden Street, sold each of them on the same day in May this year to four separate L.L.C.s named after the respective street addresses; for example, 7 Marsden Street L.L.C.

However, the New York State Division of Corporations shows that all four L.L.C.s share the same business address. Additionally, each has a development plan before the Sag Harbor Village Historic Preservation and Architectural Review Board, which often discusses them concurrently. By having the lots owned by four separate L.L.C.s, all four properties can be developed.

Ms. Schoen also said L.L.C.s have become more prevalent because of economic changes. "An increase in wealth and an increase in value, with a desire to be here, all combined to make L.L.C.s more active out here because people have the money to spend," she said.

One potential downside of putting a property in the ownership of an L.L.C. is that fewer banks are willing to lend money when a mortgage is sought, according to Bill Wright, who co-owns the Par East Mortgage Company with Pattie Romanzi. Another pitfall, Mr. Wright said, is that interest rates tend to be higher in cases where banks are lending to people who intend to close on their parcels through an L.L.C.

"There are some people who close in an L.L.C. because they don't want people to know they purchased a property. . . . They put it in the L.L.C. for protection, but when you take a mortgage, you're still on the hook for the loan," Mr. Wright explained. "You are still personally guaranteeing the mortgage, not the L.L.C. Once we explain it to people that way, to know that typically, L.L.C. mortgages have slightly higher rates than what the prevailing rate is currently, they will typically not close in an L.L.C. and just personally guarantee it the normal way."

Ms. Mehring said she feels "almost agnostic" about L.L.C. ownership.

"Sometimes our sense of community these days seems to be undermined by the feeling of, 'Oh, people are coming here and owning land and developing, and they're not connected to the community.' I don't think we can really make the judgment based on whether a piece of property in title is under an L.L.C. or an individual name," she said. "I think what you're getting at is the fabric of our community is being challenged by any entity or any people who develop properties without regard to the needs and imperatives of neighbors or the community. It's sort of a name is not just a name — it's also about the intent underlying it."