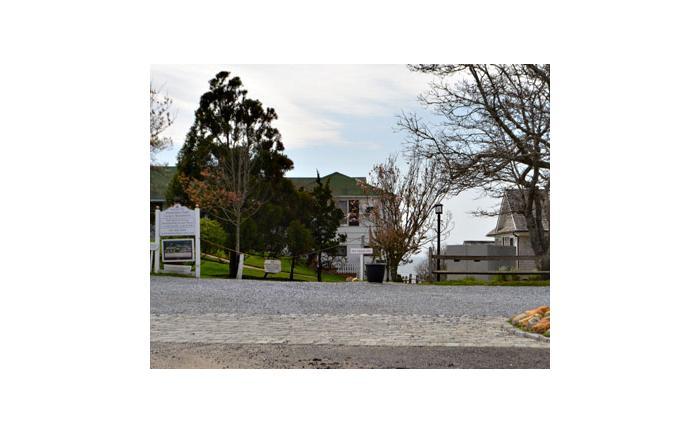

Adam J. Manson, one of two men accused of running a $118 million Ponzi scheme in connection with a failing investment in the Panoramic View Resort in Montauk, pleaded guilty in United States District Court on Monday to conspiring to commit securities fraud, a felony. Robert Nardoza, a spokesman for the Federal prosecutor, said Tuesday that all unsold units in the oceanfront cooperative, which he valued at over $60 million, will be turned over to the federal government to be auctioned. Mr. Manson, 42, of New York and Montauk could be sentenced to up to five years in prison and ordered to repay the $96 million that has not been returned to investors, Mr. Nardoza said. Mr. Manson’s brother-in-law, Brian R. Callahan, who masterminded the scheme according to the indictment, pleaded guilty on April 29 to securities and wire fraud. He faces up to 40 years in prison and is to be fined $67.4 million when he is sentenced on Aug. 8 by Magistrate Judge A. Kathleen Tomlinson. Mr. Callahan also faces having to make full restitution. It is expected that several of the victims will speak in Judge Tomlinson’s courtroom before the men are sentenced, Mr. Nardoza said. According to the indictment, Mr. Callahan had set up a series of offshore investment companies, each of which was used to hide the debt of another, while promising his investors huge returns. The brothers-in-law went into business together in October 2006 when they bought the 9.6-acre Panoramic for $32 million. With the real estate and stock markets crash that followed, the renovated two to five-bedroom units they put on the market went largely unsold. “Adam Manson assisted his brother-in-law Brian Callahan in orchestrating one of the largest Ponzi schemes in Long Island history by lying to independent auditors and lending institutions,” Loretta E. Lynch, the attorney for the Eastern District Court who prosecuted the case, said in a press release Monday. Mr. Manson was still in charge of the Panoramic View as of Tuesday morning, according to Harvey O’Brien, the company’s general manager, who would not comment further, and Mr. Manson did not respond to requests for an interview.In order to cover the $45 million in loans the pair had taken to pay for the purchase and renovations, Mr. Callahan’s Ponzi scheme, already in place, went into overdrive, with Mr. Manson becoming involved. Fictitious companies, even fictitious people, were created, fooling investors. The Montauk Fire Department, which invested $600,000 in an effort to bolster its scholarship fund, was one of the few investors that pulled out before the financial house of cards came tumbling down in February 2012, when an auditor quit because of irregularities in the books. (It had been incorrectly reported in earlier accounts that the Montauk Fire District commissioners had made the investment.) Within a month, the Securities and Exchange Commission stepped in. The Panoramic paid $78,486 in East Hampton Town property taxes last year. While most of the unsold units remain under control of the company, one unit the defendants renovated is on the open market. The four-bedroom, three-and-a-half-bathroom Hilltop, which is called a villa, is being offered at $3.95 million by Corcoran.

Attempted Swatting in Sag Harbor

Sag Harbor Village police have received several reports of “swatting” calls, falsely reporting an emergency, from Main Street businesses recently, three involving Sag Pizza and another, last week, involving Apple Bank.

In East Hampton Village, the Cameras Are Watching

East Hampton Village’s new Flock license-plate reader cameras are having an immediate effect here. Out of 18 arrests reported by village police in the last two weeks, 14 were made with the assistance of the cameras.

On the Police Logs 04.17.25

A coyote was spotted in the vicinity of Hither Hills State Park in Montauk on the morning of April 7. The man who reported it said he was worried about the safety of neighborhood pets.

Ambulance Corps Looks to Next Generation

The Sag Harbor Volunteer Ambulance Corps is hoping to broaden its membership by allowing Sag Harbor residents who are in college, or doing an equivalent educational program, to be eligible to volunteer.

Your support for The East Hampton Star helps us deliver the news, arts, and community information you need. Whether you are an online subscriber, get the paper in the mail, delivered to your door in Manhattan, or are just passing through, every reader counts. We value you for being part of The Star family.

Your subscription to The Star does more than get you great arts, news, sports, and outdoors stories. It makes everything we do possible.